Mobile Payment Solutions

The Evolution of Business: Adapting to Modern Mobile Payment Solutions

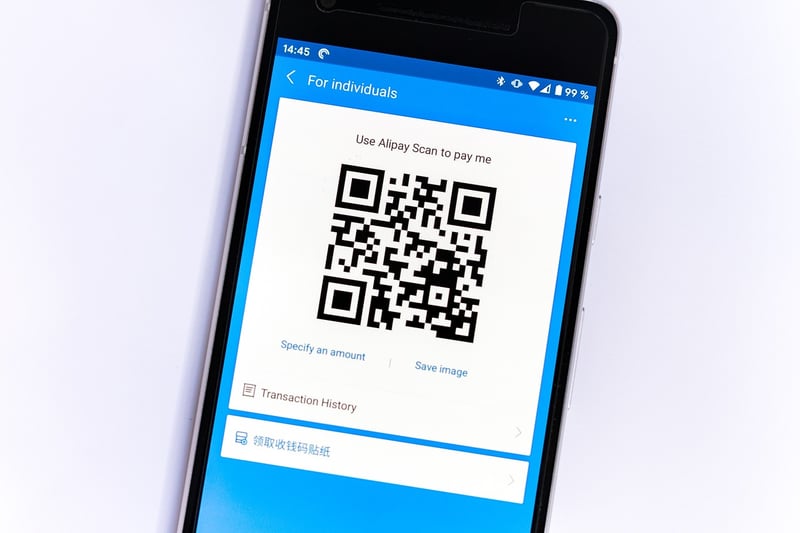

In today's fast-paced digital world, businesses are constantly evolving to meet the needs of their customers. One significant adaptation that has transformed the way transactions are conducted is the integration of mobile payment solutions.

Why Mobile Payment Solutions Matter

Mobile payment solutions refer to technologies that allow customers to make payments using their smartphones or other mobile devices. This convenient method of payment offers various benefits to both businesses and consumers:

- Increased Convenience: Customers can make payments anytime, anywhere, without the need for cash or physical cards.

- Enhanced Security: Mobile payments often use encryption and tokenization to protect sensitive financial information.

- Improved Efficiency: Transactions are processed quickly, reducing wait times and streamlining the checkout process.

- Enhanced Customer Experience: Offering mobile payment options can attract tech-savvy customers and improve overall satisfaction.

Popular Mobile Payment Solutions

There are several popular mobile payment solutions available in the market today, including:

- Apple Pay: Apple's mobile payment and digital wallet service that allows iPhone, iPad, and Mac users to make payments securely.

- Google Pay: Google's mobile payment platform that enables Android users to make contactless payments in stores and online.

- Samsung Pay: Samsung's mobile payment service that works with select Samsung Galaxy devices and allows users to make payments using NFC and MST technologies.

- PayPal: An online payment system that supports mobile payments, making it easy for customers to shop online and transfer money.

How Businesses Can Implement Mobile Payment Solutions

Integrating mobile payment solutions into a business is a strategic move that can drive sales and improve customer satisfaction. Here are some steps businesses can take to implement mobile payment options:

- Choose the right mobile payment provider based on the business's needs and target market.

- Invest in secure and reliable point-of-sale (POS) systems that support mobile payments.

- Educate staff and customers on how to use mobile payment solutions effectively.

- Promote mobile payment options through marketing channels to increase adoption rates.

Embracing the Future of Commerce

As technology continues to advance, the way businesses accept payments will also evolve. Embracing mobile payment solutions is not just a trend but a strategic decision that can propel businesses into the future of commerce.

Stay ahead of the curve and provide your customers with the convenience and security they seek by integrating mobile payment solutions into your business today.

Image Source: Pixabay